The COVID 19 pandemic has majorly affected almost all sectors. Many businesses have cut down their number of employees to save money and survive in the market. The lockdown caused a major migration throughout the world as people preferred to be in their hometown. Due to this and many other reasons, people lost their jobs. For many, it became tough to earn to complete their daily needs.

We all have that one friend who is always there with us in every crucial time. While many companies are hurdling to survive, SalaryDost is still working smart and smoothly keeping in mind its responsibility to fulfill people’s financial needs and to help them in this crucial time.

To ensure that, one should get the money in his hands at the right time, SalaryDost’s Application based lending platform will help avail short term loans in a few minutes. The needy one can get up to 1 Lakh loan in just 30 min! Isn’t it amazing?

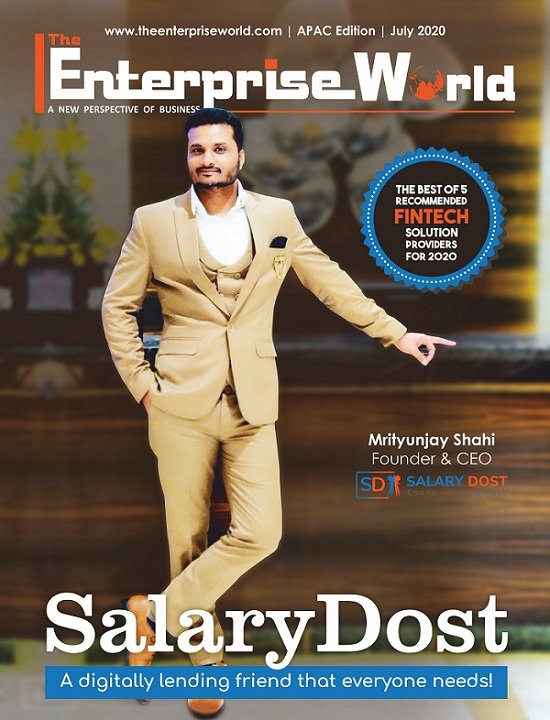

Mr. Mrityunjay Shahi, Founder and CEO at the SalaryDost and his team is making hard and smart efforts to provide comprehensive, easy, and fastest financial services.

SalaryDost’s mobile-based application is the finest strategy that will help customers get loans within a blink on an eye. The online platform is backed by a strong tech-savvy team that aims to build a quick response system for their potential clients

We, at The Enterprise World, feel proud to feature SalaryDost as a cover story of our special issue “The Best of 5 Recommended Fintech Solution Providers for 2020”.

The Inception

SalaryDost is a FinTech Company formed in 2018 and in operation for the last one year. As every business they also faced initial hurdles. But without sitting back relaxed thinking about the problems, they brainstormed for the solutions. Today, the learning they got from initial hurdles help them to overcome any issue they get stuck in. The Founder and CEO Mr. Mrityunjay says, “Moving from salary to business was the first challenge. Initially, you have to use some strategy for the business to run and do some research in the market.”

Good things come to people who wait, but better things come to those who go out and get them.

From the feedback of the customers, SalaryDost worked on the pain points, where they need to do it right, or were their solutions helping their customers. And after the research, they got an overall idea of what the customer needed and improved in those areas.

SalaryDost is a completely different platform in FinTech. They provide the loan to their customers within about half an hour of their application. The customers need to do is provide all the information and the documents and the company provides them a loan within half an hour of it.

Serving the needy with utmost services

The company focuses on providing short term loans to customers. The customers who need a loan on an immediate basis, SalaryDost is the one they are looking for. After brief documentation, the customers can avail of short-term loans on an immediate basis.

One factor that distinguishes the company from the other players in the industry is its fast and easy service. Where other players take up to 2- 3 days for the document verification and loan disbursal, SalaryDost does that in 2 to 3 hours. Thus they are helping the customers in an emergency with loan disbursal in the applicant’s account.

Fast delivery is our forte in the market and that is the reason people like our services.

SalaryDost’s offerings

• Personal Loan

Loan up to 5 Lakhs with low-interest rates and instant loan within 30 minutes

• Short Term Loan

Loan up to 1 Lakh with low-interest rates and instant loan within 30 minutes

• Home Loan

Loan up to 20 Lakhs with low-interest rates and instant loan within 30 minutes

• Education Loan

Loans up to 5 Lakhs with low-interest rates, special discounts and instant loan within 30 minutes

To take the company further in terms of services, the company is planning to launch more products in the market. They are aiming to move into the health sector too. The aim is to make SalaryDost customer friendly even more. So the plans are to expand it in such a way that the customers can use the SalaryDost platform for many other purposes rather than only short-term loans. Maybe if the customer needs home loans or loans for health purposes, so SalaryDost aims to recognize the customer needs even better and expand their array of services accordingly.

An Unmatched Leadership

Mr. Mrityunjay Shahi – Founder and CEO

Mr. Mrityunjay Shahi is a name ahead in the FinTech sector with hardcore experience in finance, banking, and insurance sectors. With about 18 years of industry experience, he brings to the table retail, core banking, insurance, wealth advice and sales expertise gained out of long term association with some of the top private banks of India.

He has wide exposure to all gamuts of retail & corporate banking, branch management, customer acquisition, build a building, bancassurance, insurance, and technology in finance. He understands the complexities and nuances of the retail debt sector and figured out many gaps that exist in the current banking industry despite the adoption of high-end technology.

Thinking should become your capital asset, no matter whatever ups and downs you come across in your life.

APJ Abdul Kalam

Mr. Mrityunjay says, “The responsibilities of an entrepreneur are to first understand the customer needs. And then according to it, you design the product or the service. Identifying the problem is the key parameter, and then how quickly you solve the problem, how efficiently you do it is the real entrepreneurship.”

The finance sector is changing every day. The RBI is coming up with the new rules every day. Mr. Mrityunjay says, “A decade ago, the financial sector dealt with more fiscal channels, but today, with new technology, almost everything is online, and the good part is that people are adopting these new channels. Technology is the game-changer for the overall financial sector.”

Mr. Manish Shukla, Co-Founder

Mr. Manish Shukla is a data scientist with 4+ years of extensive hands-on exposure to infrastructure management, data centers, data analysis, models, forecasting, visualization, time-series forecasting in R, scripting, machine learning with python and other fintech platform requirements.

Manish believes the combination of finance, technology and data is a potent combination that can solve several problems in loan space of India and the unique business model the company has identified mixes social and commercial aspects to make it lucrative for its consumers.

Mr Ashok Choudhary, Co-Founder

Mr. Ashok Choudhary is a technology entrepreneur having about 10 years of consulting, hands-on engineering and product development, and technology entrepreneurship expertise.

His expertise and revolutionary vision in the field of FinTech has helped the company to achieve a lot they wished for.

The Team

The workforce is a true treasure for any business. The team is very important for any kind of organization to grow. If your team is not efficient, you won’t be able to sustain and achieve whatever you wish to. SalaryDost is a strongly bonded family of best and multi-skilled people. When starting out, what helped was that they were able to build a good team, and after working for 2 years, they have built a good synergy among them. Different people are working in different areas and everyone is dedicated to their work. So it helps the company to provide customers with timely services.

COVID-19

COVID-19 affected the whole world a lot. During these scenarios too SalaryDost is trying their best to help the people, to disburse the loans. They are looking for a huge opportunity after the pandemic gets over. The after-effects of a pandemic must include Good opportunity and demand in the market. There have been a lot of salary cuts, job cuts in the market so now people need more money. So if they want to live the same life they were used to before 6 months, then they need additional funds and for that SalaryDost is always there to support them.

Being a digital platform it is surely an advantage because people are already on digital platforms. Things will change, people will change, and they will look at the after-scenario in a different way altogether. People are more likely to trust digital platforms more.

Things have already started to get technology-driven, more than before. It is simply because of the technology, you don’t have to go visit a bank personally to apply for loans, and you can simply download the SalaryDost app and apply for a loan from your phone. Everything is 100% safe. People just have to download and verify a few documents and then they can avail the funds almost immediately in their accounts.

The Competition

While talking about the race in the market Mr. Mrityunjay stated, “The competition in the market is like a game to play. Unless and until you don’t know how to play, you can’t win. So there are a lot of competitors in the market, and a lot of competition means that you have a good opportunity to grow. If a lot of people are entering the market it means that a lot of business opportunity is there. And how we pull ourselves through the competition is very critical. Meaning that how well aware are we of the opportunities and how effectively we grab them is what changes the game. So competition is everywhere, you just need to learn to grab the opportunities. We need to constantly evolve, re-innovate keeping in mind customer satisfaction.”

SalaryDost mainly focuses on making things easy for customers. Anyone will ever go for an easy option if there is one available.

A Message for the new entrants–

Whoever wishes to enter into the FinTech or any other industry, it is important that they first identify the problem. And this problem could be anywhere. And then you have to start thinking about how to solve it. With many entrepreneurs, it so happens that they know the solution but they don’t identify the main problem. If you are not able to identify the problem correctly, then you probably won’t get the solution correctly. So any new entrant must first identify the problem and then try to solve it in its own way. So the question to ask ourselves is “If I have this problem then in what way can I rectify it so that it will be easy for me?”